Securities Industry Essentials (SIE) Exam

Non-licensed Employees of Financial Institutions

Enroll NowWhat is the Securities Industry Essentials (SIE) Exam?

To reduce the overlapping content among exams, the SIE Exam will cover the basic knowledge that can be found on current examinations including:

- Industry structure and function

- Regulatory agencies

- Basic economics

- Basic product knowledge

- Prohibited practices

- Professional conduct

What is the Securities Industry Essentials (SIE) Exam?

To reduce the overlapping content among exams, the SIE Exam will cover the basic knowledge that can be found on current examinations including:

- Industry structure and function

- Regulatory agencies

- Basic economics

- Basic product knowledge

- Prohibited practices

- Professional conduct

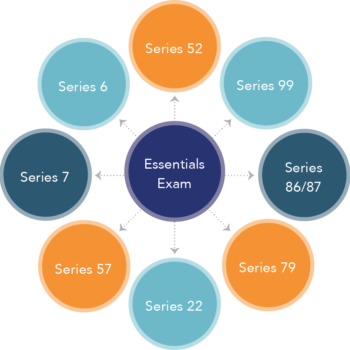

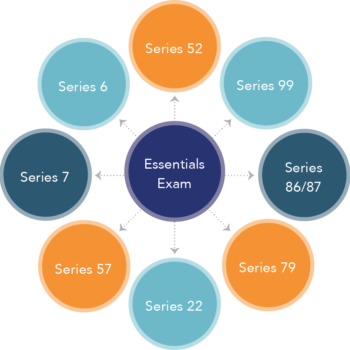

The SIE exam will serve as a precursor to taking qualifying exams in candidates’ desired area of expertise. A combination of the SIE exam and the additional test will be the equivalent to securities exams currently being offered.

The SIE exam will serve as a precursor to taking qualifying exams in candidates’ desired area of expertise. A combination of the SIE exam and the additional test will be the equivalent to securities exams currently being offered.

What the Securities Industry Essentials Exam could mean to you?

- The SIE Exam could be incorporated into your company’s annual training.

- New hires might be required to obtain the SIE exam in advance of employment.

- Firms may prefer candidates with the SIE exam on their resumes.

- The SIE Exam may become a requirement for all employees or those in select departments (e.g., legal, operations).

What the Securities Industry Essentials Exam could mean to you?

- The SIE Exam could be incorporated into your company’s annual training.

- New hires might be required to obtain the SIE exam in advance of employment.

- Firms may prefer candidates with the SIE exam on their resumes.

- The SIE Exam may become a requirement for all employees or those in select departments (e.g., legal, operations).

Benefits

- Sets you apart from other job applicants (you can add this to your resume).

- Demonstrates your knowledge of the industry.

- Opens new opportunities for you within the financial services industry.

Features

- The new format allows you to take the exam without sponsorship of a FINRAregistered company.

- A passing score on the exam is good for four years.

- If employed by a FINRA member firm, you will be able to sit for any of the registered representative qualification exams.